Table of Contents

As we move deeper into 2026, the global financial system is undergoing a quiet but historic shift. Stablecoins once seen as niche tools for crypto traders are now becoming the invisible infrastructure of the digital economy.

Cross-border payments, on-chain savings, tokenized assets, payroll, remittances and stablecoins are powering them all.

In fact, the total stablecoin supply is on track to cross $1 trillion, a milestone that puts these digital dollars in the same league as systemically important financial instruments. But this explosive growth hasn’t happened randomly. It is the result of years of experimentation, failures, and hard regulatory lessons; especially around stablecoin development models. At the center of this evolution is a fundamental design question:

Should a stablecoin be backed by real assets, or controlled by algorithms alone?

How Stablecoins Actually Stay “Stable” ?

To understand modern stablecoin development, it helps to step away from jargon and think in familiar terms.

A collateralized stablecoin works much like a secured loan. Every token you hold is backed by something tangible cash in a bank, U.S. Treasury bills, or overcollateralized crypto assets. The value doesn’t rely on market psychology alone; it’s anchored to real reserves.

An algorithmic stablecoin, on the other hand, behaves more like an automated central bank. Smart contracts continuously adjust supply minting new tokens when demand rises and burning tokens when demand falls trying to maintain price stability through incentives rather than reserves.

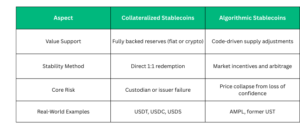

Here’s how the two approaches compare in practice:

What the market has made clear over time is that predictability beats elegance. Today, USDT and USDC together account for well over three-quarters of all stablecoin liquidity, not because they are perfect but because their backing is easy to understand, audit, and regulate.

When Algorithms Failed the Stress Test

Algorithmic stablecoins promised something revolutionary: a fully decentralized currency that didn’t depend on banks, custodians, or governments. For developers, it was the holy grail of stablecoin development.

But real markets don’t behave like controlled simulations. Most algorithmic systems rely on a mechanism known as rebasing—automatically shrinking or expanding supply to push prices back to the peg. On paper, it’s elegant. In reality, it depends entirely on one fragile factor: confidence.

When confidence disappears, the system unravels fast. The collapse of Terra’s UST remains the most cited example. Once selling pressure broke the peg, arbitrage incentives flipped into panic. What followed was a classic bank run—executed at blockchain speed—wiping out nearly $30 billion in value within days. That failure reshaped the entire industry. Even projects that once championed partial algorithms quietly changed direction. Frax, one of the most respected hybrid models, ultimately transitioned to full collateral backing after community consensus recognized that long-term trust matters more than theoretical decentralization.

The lesson was simple but brutal: Code can’t replace confidence.

The Shift Toward Yield-Generating Stablecoins

By 2026, stablecoins are no longer just static digital dollars. They’ve entered what many call the “yield phase.” Instead of issuers keeping all interest earned on reserves, newer designs distribute yield directly to users turning stablecoins into something closer to on-chain savings accounts.

One prominent example is Ethena’s USDe, often described as a “synthetic dollar.” Rather than sitting idle, it uses delta-neutral hedging strategies to generate returns, at times offering yields that rival high-risk DeFi products without direct exposure to volatile assets. But real-world events have shown that innovation doesn’t eliminate risk and it changes its shape.

When the Bybit exchange suffered a major security breach in early 2025, Ethena’s collateral remained protected. Still, the incident exposed a critical truth for modern stablecoin development: even if the token design is sound, users are still exposed to the operational risks of exchanges, custodians, and counterparties. The technology held. The infrastructure around it was tested.

Regulation Changed Everything

If one force truly reshaped stablecoin development in 2026, it wasn’t technology but it was law. For years, stablecoins lived in regulatory ambiguity. That era is over.

The passage of the GENIUS Act in the United States marked the first comprehensive federal framework for payment stablecoins. Issuers are now required to hold 100% high-quality reserves, publish regular attestations, and operate under explicit licensing regimes.

At the global level, Basel standards now require stablecoin reserves to be legally segregated. In plain terms, if an issuer fails, user funds cannot be seized to settle corporate debts. Europe’s MiCA regulation added another layer, accelerating the rise of compliant euro-denominated stablecoins. Since enforcement began, euro stablecoin circulation has more than doubled, signaling strong institutional demand for regulated alternatives to USD dominance.

These changes unlocked something crucial: trust at scale. That’s why global payment networks like Visa, Mastercard, Western Union are no longer experimenting quietly. They’re integrating stablecoins directly into settlement and cross-border flows.

Where Stablecoin Development Is Headed Next

The conversation in 2026 is no longer about whether stablecoins will survive. It’s about how deeply they will integrate into everyday finance. Banks are using them for instant settlement. Enterprises are deploying them for treasury management. Governments are studying them as programmable complements to fiat currencies.

Nearly nine out of ten financial institutions worldwide are now actively exploring or deploying stablecoin-based infrastructure. A useful way to think about this shift is technological evolution. If early stablecoins were the dial-up internet of money slow, fragile, experimental and today’s regulated, collateral-backed models are broadband: fast, reliable, and built for mass usage. Stablecoins are now processing transaction volumes that rival traditional card networks, quietly becoming the bridge between legacy finance and blockchain-native systems.

What Actually Works in 2026

After a decade of experimentation, one conclusion is clear:

The stablecoins that endure are not the most radical and they are the most disciplined.

Successful stablecoin development today blends conservative collateral management, transparent auditing, and strict regulatory compliance, while still leveraging blockchain for speed, programmability, and global access. Algorithms didn’t disappear but they moved to the edges, supporting risk management and efficiency rather than acting as the sole foundation. In the end, stability isn’t created by code alone. It’s earned through structure, trust, and accountability.

And that is what truly works in 2026.