Table of Contents

- What Security Challenges Must AI Projects Navigate? ▶

- Essential Features of Effective AI-Blockchain Integration ▶

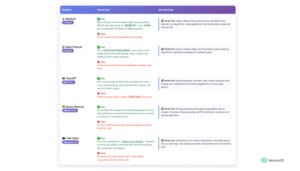

- Top AI + Blockchain Platforms for 2025

So you’re launching AI crypto project, DeFi protocol, or DAO? Then you know the biggest pain point: humans make mistakes, and blockchain doesn’t forgive them. Traditional smart contract development is slow, expensive, and risky. Human errors create perfect opportunities for catastrophic exploits and remember the 2016 DAO hack?

Here’s the reality that relying only on manual audits and human coding won’t scale in 2025. However, the solution isn’t just faster coding. Instead, it’s integrating AI to add predictive intelligence, automated defense, and unprecedented efficiency directly into blockchain architecture.

Think of this as your coffee-break consultation on moving from fragile, human-dependent systems to robust, AI-enhanced decentralized autonomy.

What Security Challenges Must AI Projects Navigate?

AI brings incredible speed and efficiency. But it also creates critical risks because you’re dealing with a fundamental clash between probabilistic AI systems and deterministic blockchain environments.

Additionally, startups face challenges feeding AI models high-quality, unbiased data. Plus, real-time performance constraints can undermine scalability goals.

The Technical Integration Problem

Here’s the core issue that blockchains are deterministic systems designed for consensus and immutable transparency. They operate with fixed, predictable logic.

Meanwhile, AI systems are probabilistic. They rely on statistical inference and adaptive learning to make predictions. So securely embedding non-deterministic AI outputs into rigid, transparent smart contracts is technically complex.

Scalability vs. Functionality Trade-offs

AI algorithms need significant computational power for both training and execution. When you deploy complex AI for real-time tasks (like predictive fraud detection), you can overwhelm blockchain capacity. This increases latency and gas costs, bottlenecking user onboarding.

Most AI computation must happen off-chain and then relay securely. However, this raises concerns about data integrity and synchronization in high-stakes financial environments.

Data Quality Issues

AI models are only as reliable as their training data. The DeFi sector offers only a few years of historical data, limiting AI model robustness compared to traditional finance with decades of data.

When you use flawed data in models like decentralized credit scoring, you create discriminatory algorithms that unfairly penalize users.

Essential Features of Effective AI-Blockchain Integration

Effective AI integration moves development from reactive failure correction to proactive system intelligence. Key features include automatically scanning smart contracts for flaws, detecting financial anomalies in real-time, and dynamically adjusting protocol settings.

Intelligent Smart Contract Auditing

AI tools use machine learning to scan code rapidly, offering real-time risk detection. They’re trained on historical exploits and best practices to identify flaws before deployment.

Large Language Models like Code Llama can generate fully functional Solidity smart contracts in seconds. In one test, developers generated a cryptocurrency token contract in just 47 seconds.

Proactive Fraud Detection

AI algorithms analyze on-chain and off-chain data to detect irregular behaviors in real time. Machine learning classifiers spot specific threats like flash loan attacks, wash trading, and front-running.

When AI detects anomalies, it automatically issues alerts or temporarily freezes smart contract functions. This shifts systems from reactive intervention to proactive defense.

Dynamic Risk Assessment

AI replaces static risk parameters in DeFi lending with dynamic, personalized risk profiling based on real-time market conditions. Reinforcement learning agents simulate lending scenarios to optimize protocol settings like liquidation thresholds.

AI agents can also autonomously manage portfolios, predict token price movements, and identify optimal yield strategies in real-time.

AI-Enhanced Scalability

AI models trained on network usage patterns dynamically allocate computational resources across different layer-2 chains. This predicts network congestion and redirects activity to maintain optimal throughput.

Top AI + Blockchain Platforms for 2025

Your platform choice depends on whether you need foundational Layer-1 infrastructure, advanced development tooling, or decentralized compute resources.

Common Integration Mistakes to Avoid

The biggest pitfall? Treating AI as a “silver bullet” solution. This leads to over-reliance on automation that ignores fundamental business logic errors.

Over-Reliance on Automated Audits

The Problem: Using AI to generate complex contracts and relying solely on AI security scores.

Why It Fails: AI-generated contracts often show security flaws comparable to human-written code. LLMs miss subtle logic errors that human auditors catch.

Solution: Use AI as acceleration, not the final word. Always subject auto-generated code to rigorous external audits. Implement hybrid models combining AI speed with human intelligence.

Centralizing Critical Decision-Making

The Problem: Using proprietary, centrally managed AI models for DAO voting or treasury allocation.

Why It Fails: While smart contracts are decentralized, centralized AI undermines the trustless blockchain ethos.

Solution: Use decentralized AI marketplaces like Ocean Protocol or infrastructure projects like Bittensor. Ensure AI models and computing power are distributed and verifiable.

Ignoring Data Bias

The Problem: Training credit scoring AI only on high-activity DeFi whale data.

Why It Fails: Models develop inherent bias, creating discriminatory algorithms that unfairly penalize regular users.

Solution: Adopt privacy-preserving AI like federated learning and differential privacy. Ensure clear audit trails for all AI-driven decisions.

Mismanaging Real-Time Latency

The Problem: AI agents processing complex datasets before executing time-sensitive trades.

Why It Fails: Processing introduces latency, making recommendations outdated by execution time.

Solution: Focus on hardware-optimized chains for latency-critical tasks. Use protocols like Chainlink Functions to minimize time between AI decisions and on-chain execution.

The Future: Intelligent and Decentralized

We’re witnessing a shift from isolated blockchain tools to full-stack, intelligent digital architecture. For crypto entrepreneurs, AI-powered blockchain development is the greatest catalyst for building resilient businesses in 2025.

By leveraging AI tools, you can reduce development time significantly while deploying autonomous defense systems that monitor against exploits in real-time.

Success hinges on adopting a hybrid strategy. Use AI for speed and complexity like predictive risk modeling and automated auditing. Meanwhile, rely on blockchain for verifiable trust and immutability.

The next generation of billion-dollar crypto projects will emerge from founders who harness AI’s adaptive intelligence while rigorously upholding core decentralized principles. The convergence isn’t just about better tools—it’s about fundamentally reimagining how decentralized systems can think, adapt, and protect themselves.

Your competitive advantage lies not in choosing between human expertise and AI capabilities, but in orchestrating them together to create something neither could achieve alone.