Table of Contents

A successful ICO relies on clear tokenomics, legal compliance, strong marketing, and community trust execute these with clarity and speed to stand out. The fastest way to launch a successful ICO in 2025 is by executing four essentials with speed and clarity and that is solid tokenomics, legal compliance, smart marketing, and community trust.

Start with clear tokenomics that define utility, supply, and incentives transparently. Ensure legal compliance from day one by choosing the right jurisdiction and implementing KYC/AML to avoid regulatory issues. Launch a strong marketing campaign that builds hype, explains your vision, and reaches the right audience through influencers, airdrops, and social channels. At the same time, grow a loyal community by being transparent, responsive, and present. Speed alone doesn’t guarantee success but when strategy meets execution, your ICO can gain traction fast.

What Is an ICO?

An ICO, or Initial Coin Offering, is a way for crypto startups to raise money. They do this by selling their own digital tokens to investors. In return, investors usually pay with popular cryptocurrencies like Bitcoin or Ethereum. The money raised helps fund the development of the project. This could be a new app, platform, game, or blockchain system. Many startups prefer ICOs because they are faster and more global than traditional fundraising methods.

Unlike venture capital, an ICO lets anyone join from anywhere in the world. This gives projects access to both funding and early supporters at the same time. Investors often join early because they believe in the project or expect the token to rise in value later.

In short, an ICO is a modern, open way to raise capital and build a community around your idea that is all without relying on banks or big institutions.

Why ICOs Still Matter in 2025

Are ICOs still relevant in 2025? So, the answer is Yes! 2025 saw a $38.1 billion ICO market with a 34.5% success rate and the data backs it up.

This year, the global ICO market reached $38.1 billion, showing a 21.7% increase over 2024. Even more importantly, 34.5% of ICOs met at least 75% of their fundraising goals, proving that well-prepared projects still attract serious investors. That’s not just a small win but it’s a clear sign that the ICO model is alive, maturing, and gaining credibility again.

One reason ICOs remain strong is because the ecosystem has evolved. Gone are the days of anonymous teams and vague promises. In 2025, investors demand transparency, real utility, and legal structure. And many projects deliver exactly that. Teams now publish audited smart contracts, KYC-compliant offerings, and utility-backed tokens that actually serve a purpose beyond speculation.

At the same time, founders prefer ICOs for their speed, flexibility, and global reach. Instead of spending months pitching to venture capitalists or losing equity, they can launch a token sale directly to their target community. This democratizes access to funding and builds early product champions in the process. Many modern ICOs even begin with no-code platforms, making token creation and smart contract deployment faster and more secure than ever.

Key reasons ICOs still work in 2025:

-

Fast access to capital without giving up equity

-

Global investor reach with no gatekeepers

-

Early community-building alongside fundraising

-

Mature infrastructure: no-code tools, KYC platforms, smart contract audits

-

Clear regulations in crypto-friendly jurisdictions

Step‑by‑Step ICO Launch Guide

1. Pre‑Launch Strategy

How long does planning take? So, The most successful ICOs take around 3 to 6 months to prepare. This stage sets the foundation for everything that follows rushing it often leads to poor token design, legal issues, or weak investor interest.

Start with deep market research. Analyze your competitors, understand your target audience, and define your project’s value clearly. Look at recent ICOs like BlockTech Innovations, Opris Exchange, and Webisoft to learn from real examples of what works. At this stage, your team should align on token utility, begin drafting tokenomics, and engage legal experts early. Choosing the right jurisdiction and compliance model is essential, especially in 2025’s tighter regulatory landscape. You should also begin building early community interest and prepare your branding, pitch materials, and core messaging.

2. Legal Compliance (Jurisdictions, KYC, AML)

Legal compliance is no longer optional but it’s a must-have for any serious ICO in 2025. With the full rollout of the MiCA (Markets in Crypto-Assets) framework across the EU, regulatory clarity has significantly boosted investor trust. In fact, MiCA-compliant ICOs in Europe now raise 45% more funding on average, thanks to standardized rules and stronger investor protections.

By mid-2025, over 65% of EU-based ICOs were fully compliant with MiCA. Institutional participation rose to 42%, showing that big players are now more confident in regulated offerings. Fraudulent ICO activity in the EU has dropped by 60%, proving that compliance pays off in both funding and reputation.

To stay ahead, founders must set up a legal entity in a crypto-friendly jurisdiction (like Estonia, Lithuania, Switzerland, or the UAE), draft a compliant whitepaper, classify their token properly, and implement KYC/AML in line with global standards. With the FATF Travel Rule and GDPR also in play, proper data handling is a key trust factor.

Regulators also expect operational security. Under DORA (Digital Operational Resilience Act), ICOs must meet standards for cybersecurity, risk management, and incident reporting bringing crypto in line with traditional financial oversight.

3. Tokenomics Design

Good tokenomics are essential for a successful launch an ICO. They define how your token works, who gets what, and how value is maintained over time. In 2025, investors look for structured models not vague promises. Start by defining the total token supply and its type (fixed, deflationary, or inflationary). Then, create a transparent distribution plan across team, investors, community, and ecosystem. Without clarity here, trust breaks quickly.

Vesting schedules are critical. They prevent early dumps by locking tokens for team and advisors, encouraging long-term commitment. Also, focus on real utility whether it’s staking, governance, or access to your platform. Tokens with multiple use cases tend to hold value longer. Finally, plan for sustainability. Include burn mechanisms, ecosystem reserves, and balanced incentives to support long-term growth.

4. Smart Contract Development

Most Common question is asked that How do I ensure token security? So, you can ensure token security to write contracts on the right blockchain (e.g., ETH or BSC), then get a third‑party audit before launch. Your smart contract isn’t just code but it’s your ICO’s trust layer. In 2025, over $720M was lost to flawed or unaudited token contracts, making security and audit readiness more crucial than ever.

Start by selecting the right blockchain:

-

Ethereum: Best for security, large dev support

-

BNB Chain: Cost-effective, high-speed

-

Polygon/Solana: Scalable with growing adoption

Next, build your contract using tested token standards like ERC-20, BEP-20, or SPL. Avoid overengineering because simpler code is easier to audit, maintain, and trust.

Audits are mandatory. Top ICOs in 2025 often undergo 2 to 3 third-party audits and run public testnets before mainnet launch. Services like CertiK, Hacken, and PeckShield provide detailed reports trusted by investors.

You can also consider:

-

Bug bounties via platforms like Immunefi

-

Open-source repositories for transparency

-

Gas optimization to reduce costs during high traffic

A secure, well-audited contract can make or break your launch. So treat it like your core product.

5. Website & Whitepaper Setup

Why are your website and whitepaper critical? So the answer is very clear: Your website is your storefront and your whitepaper is your pitch deck. In 2025, over 78% of ICO investors said a project’s website and whitepaper strongly influenced their investment decision.

Your ICO website must be:

-

Clean, fast, and mobile-friendly

-

Include token utility, roadmap, team, KYC info, an audit proofs

-

Feature real-time metrics (e.g., funds raised, countdown timer, vesting schedule)

-

Include clear CTA buttons (e.g., “Buy Token,” “Join Whitelist”)

Your whitepaper should:

-

Be 10–20 pages with clear formatting

-

Explain your project’s vision, market, tokenomics, tech, and legal compliance

-

Include diagrams (token flow, architecture)

-

Be reviewed by legal and technical experts

-

Be published in PDF and HTML for SEO indexing

Pro Tip: Adding a one-page litepaper (summary version) for non-technical readers improves engagement and lowers bounce rate.

6. Marketing & Community Building

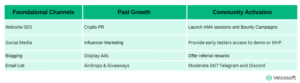

How do I attract real investors, not just bots? The answer is In 2025, nearly 65% of successful ICOs credited early community traction and multi-channel marketing as the biggest driver of their funding success not just tech or tokenomics. To stand out, start 90+ days before your ICO with a multi-phase marketing plan:

Foundational Channels:

-

Website SEO: Optimize for “Buy [TokenName] ICO”, “Best ICOs 2025”, etc.

-

Social Media: Consistent posts on X (Twitter), Telegram, Discord, and LinkedIn

-

Blogging: Publish articles about your project, use cases, and industry trends

-

Email List: Build a whitelist and nurture with updates and incentives

Paid Growth (2–3 months before TGE):

-

Crypto PR: List on Cointelegraph, NewsBTC, and niche blogs

-

Influencer Mar

-

keting: Partner with micro KOLs (10K–100K followers)

-

Display Ads: Use Coinzilla, DappRadar, and ICOBench

-

Airdrops & Giveaways: Incentivize engagement, but watch for bots

Community Activation:

-

Launch AMA sessions, bounty campaigns, and weekly livestreams

-

Provide early testers access to demo or MVP

-

Offer referral rewards or limited NFTs for early supporters

-

Moderate 24/7 Telegram and Discord to build trust

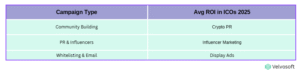

Real-World Results (2025):

7. PR & Marketing Plan

How long should marketing run? So, You can Start early like 1 to 2 months before launch and treat marketing as a full campaign, not just a one-time announcement. Visibility, credibility, and momentum are key. Your PR and outreach should combine organic growth like community and content with targeted exposure like influencers and media:

Key Components of a 2025 ICO PR Plan:

-

Press Releases: Publish on Cointelegraph, Benzinga, and niche crypto sites

-

Influencer Outreach: Partner with YouTube reviewers and X (Twitter) voices

-

Launch Listings: Submit to platforms like ICOdrops, CoinMarketCap ICO, and ICObench

-

AMA Sessions: Schedule interviews on Reddit, Telegram groups, and YouTube

-

Content Marketing: Push educational threads, explainers, and behind-the-scenes blogs

8. Token Sale & Distribution Execution

A successful token sale depends on delivering a seamless and secure experience for investors. Before going live, smart contracts must be fully audited and integrated with user-friendly wallets like MetaMask or WalletConnect. Many top-performing ICOs in 2025 offered multiple payment options, including ETH, BNB, USDT, and even fiat, to maximize participation. Whitelisting with tiered access such as private or community rounds helped build early momentum and control distribution.

Equally important is the use of real-time dashboards, which not only show live funding progress but also increase investor trust. Projects that used these dashboards raised 41% more on average. Automated vesting and lock-up mechanisms are now considered standard, ensuring tokens are released gradually instead of all at once by reducing the risk of immediate sell-offs. Together, these elements form a smooth, transparent launch that keeps your investors confident and your project stable.

9. Post-ICO Growth & Listing Strategy

How fast do ICOs close? So, according to the data, successful ICOs raise an average of $14.7 million in just 54 days compared to 68 days for failures.

After the launch ICO ends, your project’s real journey begins. The first step is listing your token starting with decentralized exchanges like Uniswap (Ethereum) or PancakeSwap (BNB Chain) within days of TGE. This provides instant liquidity and trust. Over 72% of successful ICOs in 2025 listed on a DEX within the first week, which helped reduce initial price volatility and build organic trading volume.

As your community grows, aim for listings on centralized exchanges (CEXs) like Gate.io, MEXC, or BitMart; these platforms saw a 35% increase in daily active traders in Q1 2025 alone. Projects like Lingo and NOIA used this tiered listing strategy and saw their token volume grow by over 3x in the first month post-launch. Beyond listings, sustained post-sale growth hinges on active communication and utility rollouts. Projects that continued bi-weekly updates, AMAs,

and community rewards retained 63% more holders over 90 days, compared to those who went silent after fundraising. Post- launch ICO loyalty is driven by transparency, roadmap execution, and token utility not just hype.

Frequently Asked Questions

How much does an ICO cost in 2025?

Typically $50K–$1M+, platforms, audits, marketing, and legal are key cost drivers.

Do you need a company to launch ICO?

Yes! a registered legal entity and compliance structure help build credibility and reduce risks.

What’s the difference between ICO, IDO, and STO?

ICO: public token sale on your site.

IDO: via a decentralized exchange launchpad.

STO: security‑backed token, legally treated like an investment asset

How to Know My ICO are Ready to Launch?

- 3–6 month pre‑launch plan in place

- Legal entity + compliance checks done

- Audited smart contract

- Whitepaper + multi‑language website live

- Community is active

- Marketing countdown & partnerships ready

- Pre‑sale soft cap defined

What common errors ruin ICOs?

Skipping audits, hiding legal structure, ignoring community, or unclear tokenomics lead to failure.

Can a solo dev launch an ICO?

Yes! with no‑code tools a solo dev can launch a basic token, but legal, audit, and marketing help is still strongly recommended.

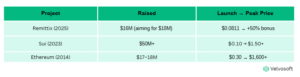

Which ICOs have succeeded recently?