Table of Contents

Web3 is the decentralized future of the internet that is built on the blockchain technology. In this era, it’s not a buzzword for any tech enthusiast. It’s a rapidly evolving ecosystem that’s maturing fast, especially in 2025. From the way we manage digital identity to how we transfer value, build apps, or even create art, Web3 is reshaping the internet at every layer at a very fast rate.

This year is especially pivotal. Advancements in decentralized finance (DeFi), digital identity systems, regulatory clarity, and infrastructure tooling are setting the stage for Web3 to move from early adopter territory into broader enterprise and user adoption.

But what’s fueling this momentum? How does this work? Let’s take a look at the trends, technologies, and transformations driving the Web3 movement.

Developers Are Doubling Down on Web3

The number of active developers in the blockchain space has seen a remarkable increase, particularly around L2 ecosystems, app chains, and modular stack tooling. And it’s not just growth, in fact it’s smart and focused growth. New developers are entering the space faster than before, largely because of improvements in AI-assisted coding tools, clearer documentation, and modular SDKs that simplify launching new chains or decentralized applications. What used to take weeks now takes days and that’s accelerating innovation across the board.

Technological Advancements in Web3

1. Decentralized Identity (DID) Takes Center Stage

Forget relying on centralized platforms to verify who you are. Decentralized Identity systems (DIDs) are giving users back control over their digital presence. These systems use blockchain to secure and manage identity data, and they’re growing fast in adoption.

One standout is Worldcoin’s proof-of-personhood model. It’s leading the charge in identity authentication that doesn’t require giving up personal data. More DID systems are now combining zero-knowledge proofs and biometrics, offering new ways to verify identity across DeFi platforms, DAOs, NFTs, and even in IoT networks and AI agents.

2. Layer 2 and Cross-Chain Innovation

In 2025, we saw a major breakthrough with Ethereum’s Dencun upgrade (a combination of Cancun and Deneb) and have a glimpse idea of that scalability is always on the top of the blockchain. This upgrade expanded how data is stored for rollups, which slashed Ethereum’s transaction costs dramatically from about $86 per swap to just $0.39.

This has supercharged Layer 2 (L2) networks like Optimism, Arbitrum, and Base. Over 25 new rollups have launched since the start of 2024, making these ecosystems more robust and diverse than ever. Meanwhile, cross-chain bridges like Cosmos’ IBC and Chainlink’s CCIP are evolving to support seamless asset transfers. Still, bridge security remains a challenge; over $2.8 billion was lost to bridge-related exploits.

3. Web3 x AI: The New Frontier

Artificial intelligence is not just changing the Web2 world but it’s now a cornerstone of Web3 innovation too.

AI-powered tools are enabling smarter DeFi algorithms, automating governance decisions in DAOs, and creating entire marketplaces for AI-generated art and content. DeFi protocols now use machine learning models to dynamically set lending rates and manage risk. In creative industries, artists are minting AI-generated NFTs and earning token-based royalties. This is laying the foundation for a “creator economy” that’s both decentralized and intelligently automated.

Business Applications Gaining Serious Traction

1. DeFi 2.0: Beyond Lending and Swapping

Decentralized finance is evolving rapidly. It’s no longer just about basic swaps or collateralized loans.

In 2025, leading DeFi platforms like Aave and Lido collectively manage tens of billions in on-chain assets. There’s a major rise in yield-bearing stablecoins and tokenized real-world assets (RWAs), including treasury securities. In fact, tokenized treasuries have seen a staggering 414% growth this year. The supply of stablecoins also grew by 59% in 2024 alone, cementing their role as the lifeblood of on-chain transactions.

Meanwhile, banks and asset managers are cautiously entering the space. Many are experimenting with hybrid finance models that merge the transparency of DeFi with the stability of TradFi (traditional finance), thanks to improved regulatory clarity.

2. Supply Chains Meet Blockchain

Supply chains are getting smarter with blockchain. Companies like Walmart and Maersk are already tracking food and cargo shipments on decentralized ledgers.

A key area of interest is DePIN (Decentralized Physical Infrastructure Networks) where blockchain meets IoT. Sensors and GPS-enabled devices feed real-time data into secure, immutable ledgers. Governments are exploring DePIN for everything from public transportation tracking to infrastructure management.

This blend of real-world data and blockchain integrity is transforming supply chains into transparent, tamper-proof systems.

3. The Rise of the Creator Economy

Web3 is changing the game for content creators, musicians, and digital artists.

NFTs are no longer just profile pictures but they now include everything from tokenized real estate to gated content subscriptions. Creators are building communities around social tokens and DAOs, where fans can buy access, vote on decisions, and share in success.

Platforms like Audius and Zora are pioneering decentralized media platforms where royalties are paid instantly and transparently. Meanwhile, AI-generated content is opening up entirely new revenue models; one where creators tokenize their outputs and automate licensing through smart contracts.

4. Gaming and the Metaverse

Blockchain gaming experienced significant growth in 2024, with daily active wallets in Web3 games reaching approximately 7.4 million, a 421% year-on-year increase. Layer 2 chains focused on gaming, such as ImmutableX on Ethereum, are gaining market share, even surpassing Ethereum in NFT trading volume for gaming items in 2024. Major gaming franchises and indie developers are exploring tokenized assets and crypto rewards. However, venture capital investment in blockchain gaming declined by 38% to around $1.8 billion in 2024, indicating consolidation and strategic pivots among game startups. Looking forward, Metaverse projects and Web3 game studios are expected to mature, with interoperability of gaming NFTs and cross-platform economies becoming increasingly significant.

Investment Trends and Funding Patterns

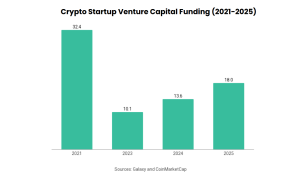

Venture capital investment in crypto and Web3 rebounded in 2024, totaling $13.6 billion, up from $10.1 billion in 2023, though still below the 2021 peak of approximately $32.4 billion. Galaxy Research reports that 2024 saw about $11.5 billion invested across over 2,150 deals. PitchBook data indicates a shift towards selective investments, with Q4 2024 witnessing fewer deals but higher per-deal funding, suggesting a focus on established teams and innovative layers. Web3 infrastructure, including scaling solutions, DAOs, NFT platforms, and AI-crypto projects, attracted the majority of VC funding in 2024. Analysts project a 50% year-over-year increase in crypto VC funding for 2025, driven by easing macroeconomic headwinds and clearer regulatory frameworks.

Notable funding rounds in late 2024 include $225 million for Monad (an Ethereum-layer-1 project), $100 million for Berachain (a modular blockchain), and $70 million for Bitcoin-staking protocol Babylon. Institutional players are also entering the space, with asset manager BlackRock funding a crypto tokenization platform in late 2024. These trends indicate a flow of capital into emerging primitives like stablecoins, tokenized real-world assets, and AI-blockchain synergies poised for broader adoption.

Global Regulatory Developments in Web3

European Union

The European Union has taken a major step toward unified crypto regulation with the full implementation of the Markets in Crypto-Assets (MiCA) framework on December 30, 2024. MiCA brings clear rules to the table for crypto issuers and service providers across all EU member states. This includes mandatory disclosures, authorization processes, and stability requirements, especially for stablecoin issuers. Alongside MiCA, the EU also rolled out a new Anti-Money Laundering (AMLA) framework. This framework requires crypto firms to follow strict customer verification rules under the “Travel Rule,” aiming to safeguard consumers while encouraging innovation.

United States

In 2025, the U.S. pushed forward with significant crypto regulation through the GENIUS Act. This legislation targets stablecoins, enforcing strict consumer protection measures and emphasizing national security and financial stability. Key rules include mandatory audits, a ban on interest-bearing stablecoins, and strong penalties for non-compliance. Meanwhile, regulatory agencies like the SEC, CFTC, and IRS have been active in clarifying their roles in crypto oversight. At the state level, places like Wyoming have already introduced special charters for crypto banks, while others explore digital asset licensing.

Asia-Pacific

Regulations in Asia-Pacific vary widely. China remains firm in its ban on crypto trading but continues to expand its digital yuan. On the other hand, countries like Singapore, Japan, and South Korea have implemented detailed regulatory frameworks for exchanges and custodians. Hong Kong’s SFC introduced a crypto licensing regime in mid-2023, allowing licensed platforms to operate legally. India, meanwhile, is drafting a comprehensive digital assets bill focused on taxation and compliance, following its implementation of a 30% tax on crypto gains in 2022.

Other Regions

The UK is stepping up oversight through its Financial Conduct Authority (FCA), which is working on stablecoin regulations and rules for crypto custody as of mid-2025. Meanwhile, countries in the Middle East, including the UAE and Bahrain, are positioning themselves as crypto innovation hubs with business-friendly regulatory frameworks. Globally, regulators are starting to align. The G20’s endorsement of international crypto guidelines is a major move toward consistent global standards that support innovation while ensuring consumer protections.

Key Challenges in the Web3 Space

-

Scalability

Despite major tech upgrades like Ethereum’s Dencun update and a growing number of Layer 2 solutions, blockchain scalability remains a hurdle. Network congestion can still lead to high fees and slow transactions. Ongoing R&D into zero-knowledge rollups, sharding, and improved consensus models is critical to scaling Web3 applications for mass use.

-

User Experience (UX)

User-friendliness remains a pain point. Most Web3 apps still require users to grasp difficult concepts—private keys, seed phrases, gas fees, and wallet compatibility. This complexity turns off mainstream users. While wallets like MetaMask and Coinbase Wallet have improved the experience, the learning curve remains steep for new users.

Efforts to make Web3 more intuitive include:

- Smart contract wallets with account abstraction (e.g., ERC-4337)

- Web2-style logins via platforms like Web3Auth and Magic

- Gasless transactions funded by the app or third-party relayers

Still, the space lacks a consistent, cross-platform UX standard, which continues to limit adoption.

-

Security and Fraud

Security is a constant concern. Despite better audits and security practices, 2024 saw over $1.8 billion lost to scams, hacks, and exploits. Common vulnerabilities include:

- Flawed smart contracts (e.g., logic bugs, reentrancy issues)

- Oracle manipulation

- Bridge exploits between blockchains

- Private key leaks and phishing attacks

To combat this, new security strategies are emerging:

- Real-time monitoring tools (e.g., Forta, Chainalysis KYT)

- Bug bounty platforms like Immunefi

- DAO treasury protections via multisig or threshold wallets

As systems grow in complexity, their vulnerabilities increase too. Security innovation must keep pace.

-

Regulatory Uncertainty

Although regulatory clarity is improving, inconsistencies remain across regions. Issues that complicate compliance include:

- Conflicting definitions of crypto assets (security vs. commodity)

- Lack of legal frameworks for DAOs and DeFi protocols

- Varying tax treatment of crypto income

- Restrictions on privacy-enhancing tools like mixers

For startups and enterprises operating globally, this creates confusion and risk. The emergence of Web3-focused regulatory tech (RegTech) tools is helping to navigate this challenging landscape.

What’s Next for Web3?

Short-Term Outlook (2025–2026)

- Tokenized real-world assets (RWAs) like real estate, stocks, and government bonds will be more widely adopted, especially by traditional finance (TradFi) institutions.

- More enterprises will integrate blockchain into areas like supply chains, digital identity verification, and legal document signing.

- Ethereum’s ecosystem will continue its shift to rollups, with Layer 2s like Arbitrum, Optimism, and zkSync leading in dApp traffic.

- The fusion of AI and Web3 will birth new use cases, especially in the creator economy and data intelligence.

- DAOs will continue to mature with better tooling, clearer legal protections, and hybrid models that blend corporate governance with decentralized principles.

Long-Term Vision (2027–2030)

- Web3 becomes the underlying infrastructure for owning, managing, and exchanging digital assets and information.

- Blockchain tech becomes invisible seamlessly integrated into daily apps and digital services.

- A global identity and reputation system will form the backbone of decentralized interactions.

- Decentralized physical infrastructure (DePIN) networks, such as Filecoin and Helium, will challenge traditional cloud and telecom giants.

- Global regulatory convergence will unlock international innovation and allow projects to scale without facing legal fragmentation.

Final Thoughts

Web3 in 2025 is no longer just a tech trend; it’s a foundational shift in how we build, own, and interact online. As the ecosystem matures through technological breakthroughs, regulatory alignment, and pragmatic use cases, it invites developers, enterprises, and users alike to co-create a more open, transparent, and equitable digital future.

While challenges remain, from UX hurdles to legal ambiguity, the direction is clear: Web3 is becoming a core layer of the internet. Staying informed and adaptable is critical whether you’re building, investing, or participating. The future is decentralized, and it’s happening now.