Table of Contents

The DeFi wave is reshaping global finance. As of 2025, decentralized exchanges (DEXs) hold approximately 32% of the total DeFi market and are growing at a staggering CAGR of ~53–54%, with the global DeFi market poised to rise from $20.48 billion in 2024 to over $231 billion by 2030.This growth surge is powered by unstoppable adoption across retail and emerging institutional users globally.

At the same time, crypto itself has crossed $3.46 trillion in market cap by mid‑2025, up 45% year‑on‑year, spanning over 16,000 tokens across more than 1,200 exchanges. Faced with this booming environment, startups and exchange operators confront a vital choice: should you opt for a white-label DEX fast and cost-effective or invest in a custom-built platform, offering complete control and differentiation?

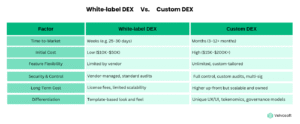

Quick Comparison Table

White-label and custom DEX solutions solve different business needs. Below, we explain the key differences so you can decide which approach fits your goals, budget, and timeline best.

DeFi & DEX Market Overview

Market Size & Growth: The DeFi market was valued at $20.48B in 2024, with projections to hit $231B by 2030; a CAGR of ~53.7%.Within it, DEX aggregators are expanding at ~35% CAGR and expected to reach over $50 billion in total value locked by 2030, processing ~$1.5 trillion in volume annually.

By mid‑2025, average daily DEX volume has surged, with top platforms such as Uniswap hitting ~$3.3B/day and holding near 23% of DEX trading volume.

Infrastructure Trends: Layer‑2 scaling solutions (e.g., Arbitrum, Optimism) have lowered per-trade costs below $0.20, enabling micro‑transactions and boosting DeFi accessibilitY.

Institutional Momentum: Institutions are entering DeFi, using tokenized assets, staking, and stablecoins to enhance treasury flows. Asia-Pacific markets, supported by clearer regulation (e.g. Hong Kong, Singapore), lead adoption at ~19% CAGR.

White‑label DEX: Fast and Efficient

What is White Label DEX?

A white-label DEX is a ready-made platform you can brand and launch rapidly. It includes features like AMM, wallet integration, liquidity sourcing, staking, and admin dashboards.

Advantages:

- Rapid deployment: Go live within weeks.

- Low upfront cost: Typically $10K–50K, depending on provider and customization options.

- Built-in security protocols: Pre-audited smart contracts managed by the provider.

Drawbacks

- Customization limits: Feature choices and UI are constrained by provider templates.

- Vendor lock‑in: Updates, roadmaps, and scaling depend on the provider.

- Recurring costs: Licensing, transaction fees, and limited ability to pivot to custom modules later.

Custom DEX Development: Full Control, Full Flexibility

What is Custom DEX?

A custom DEX is built from scratch to meet your platform’s unique vision—everything from smart contracts to governance, UI/UX, staking, and liquidity logic.

Pros

- Tailored features: From cross-chain pools and advanced tokenomics to gamified interfaces and governance tokens.

- Ownership & control: You own the codebase, audit schedule, and scalability.

- Scalable architecture: Designed for long-term growth and flexibility.

Cons

- Higher cost and time: 3–12+ month development cycles with budgets of $15K–$200K+.

- Requires technical expertise: In-house or partner teams must manage security, UX, and integration complexity.

Hybrid Strategy: Launch Fast, Scale Later

One highly effective option is the hybrid approach: begin with a white-label DEX solution for fast market entry, then gradually enhance it with your own custom modules. Launching initially with core components like token governance mechanisms, user interface refinements, or optimized liquidity routing allows you to hit the ground running.

As your platform evolves, you can introduce bespoke features such as tailored tokenomics, unique UI/UX flows, governance structures, or advanced routing logic that reflect your brand identity and growing user base. This method blends the immediacy of plug-and-play deployment with the adaptability of progressive customization, giving you both speed and strategic flexibility. It’s a risk-aware pathway: you start with something reliable and proven, then incrementally layer in innovation and differentiation as you gain traction and clarity on future objectives.

Security & Governance: Why It Matters?

When choosing between white‑label and custom DEX solutions, the difference in security capabilities becomes particularly significant in mature DeFi markets.

White‑label DEX platforms come with essential protections built-in, such as standard audits, multi-signature wallet support, and foundational compliance protocols. These features provide a solid launchpad but often have limitations when it comes to advanced governance, upgrade flexibility, or dynamic risk mitigation. While they offer baseline security, their governance frameworks like upgrade paths, multi-sig thresholds, and MEV defenses are typically fixed by the provider and not easily customizable.

In contrast, custom-built DEX platforms open the door to fully configurable security architecture. With a bespoke approach, you can implement:

- Configurable multi-signature wallets (e.g. 4-of-6 thresholds) to distribute administrative control and prevent single-point failure

- Formal verification and audit cycles, combining automated analysis tools (Slither, Mythril) with manual, third-party reviews for stronger assurance

- MEV-resistant architecture, like commit-reveal schemes, encrypted mempools, batch auctions, and private order flow systems that thwart frontrunning and sandwich attacks

Beyond these configuration options, custom platforms allow continuous improvement strategies: you can institute on-chain risk scoring, operate real-time monitoring dashboards, integrate bug bounty programs, and iterate governance rules through DAO voting.

This level of adaptability is essential for establishing institutional-grade trust and regulatory alignment. When scaling a platform for broader user bases or enterprise exposure, full control over your security and governance stack is not just a nicety but it’s a necessity.

UX & Mobile: Driving Adoption

In today’s crypto ecosystem, mobile devices are the primary gateway to DeFi. By the end of 2024, 36 million active crypto wallets were in use on mobile devices an all-time high and account for approximately 87% of all crypto transactions globally. This shift marks a pivotal move from passive holding to active engagement, where user experience becomes a critical differentiator.

White-label DEX platforms typically rely on responsive template designs that work on mobile screensbut they often fall short in delivering optimized onboarding flows, localized interfaces, and seamless wallet integrations. These limitations may be satisfactory for early-stage users but can hinder retention and growth as global transactions surge.

In contrast, custom-built DEX platforms allow full control over mobile UX from signup to trading execution. You can fine-tune features such as onboarding sequences, wallet connectivity, language localization, and responsiveness to different mobile environments. This tailored approach helps reduce friction and elevate trust during the user journey.

Key mobile UX features to prioritize in custom DEXs:

- Fast-loading interfaces and intuitive trade workflows

- UI tailored for various mobile devices and connection speeds

- Localized formats for language, dates, currency units, and identity input methods

By investing in a mobile-first custom experience, you can significantly improve conversion and retention among casual or new crypto users transforming basic access into platform loyalty.

Real‑World Stats & Industry Examples

- Uniswap, the largest DEX by volume, processed over $3 trillion cumulative trades by 2025, averaging $3.3 billion/day across chains like Ethereum, Polygon, and Arbitrum.

- In Q1 2024, Solana’s DEX volume jumped 300% to $1.5 billion/day, with TVL rising over 200% to ~$5 billion.

- The broader crypto exchange ecosystem saw $18.83 trillion in centralised exchange trading volume in 2024 though DEXs are steadily growing share as users shift toward decentralization and control.

When to Choose Each Approach

Not sure which option is right for you? Below is a simple guide to help you choose between white-label, custom, or hybrid DEX development based on your goals, budget, and long-term plans.

Choose White‑label When:

- You need a fast, cost-effective launch to test market fit

- Budget or technical capability is limited

- Your feature needs align with provider templates

Choose Custom When:

- You need full control, feature flexibility, and branded differentiation

- Planning long-term growth and scalability

- Security, governance, and custom integrations are critical

Consider Hybrid If:

- You want to launch quickly but later expand features uniquely

- You intend to gradually migrate to own tech stack

- You prefer lower initial risk and staged investment

Frequently Asked Questions

Q: Is white‑label DEX cheaper?

A: Yes! initial costs are low ($10K–50K), but you may face recurring fees and flexibility constraints. Custom DEX costs more upfront ($15K–200K+), but offers long-term scalability and ownership.

Q: How quickly can a white‑label DEX go live?

A: Typically within weeks. Your team’s launch timeline of 25–30 days exemplifies that efficiency.

Q: Can a custom DEX support cross‑chain liquidity?

A: Absolutely! it’s one of the primary advantages of a bespoke platform.

Q: Are white‑label platforms audited?

A: Most include baseline audits. Custom platforms allow full audit customization and frequency.

Q: When should you migrate from white‑label to custom?

A: When your use-case or scale demands exceed template constraints, or you require brand control or regulatory compliance.

Conclusion: Your Path Forward

The DeFi market is rapidly evolving, and choosing the right DEX strategy can significantly influence your platform’s success. TidalDex, a white‑label solution, enables rapid deployment with lower upfront costs and operational simplicity, allowing you to enter the market efficiently. Alternatively, custom development gives you full control over architecture, scalability, and feature design perfect for brands prioritizing long-term differentiation and innovation. For many organizations, a hybrid approach offers the best of both worlds: you can launch quickly with a white‑label base and then gradually introduce custom modules to align with evolving goals. By evaluating these options in the context of your long-term vision and your growth trajectory, budget, and strategic roadmad; you can confidently choose a path that balances speed, flexibility, and quality.