Table of Contents

- What Makes Real-World Asset Tokenization Different from Regular Crypto? ▶

- Essential Components for Successful RWA Tokenization ▶

- How Physical Assets Actually Become Smart Contract Tokens? ▶

- Top RWA Tokenization Platforms Compared: Which Solution Fits Your Assets? ▶

- Implementation Roadmap: From Concept to Live RWA Tokens ▶

- Critical Mistakes That Destroy RWA Projects (And How to Avoid Them) ▶

- The Technical Deep-Dive: Smart Contract Architecture for RWA Tokens ▶

- Real-World Success Stories: RWA Tokenization in Action ▶

- The Economics of RWA Tokenization: Costs, Benefits, and ROI Analysis ▶

- What is the Future of RWA Tokenization ▶

- Final Thougts: Your RWA Tokenization Action Plan

Imagine You are owning a $500,000 property but being unable to sell a 10% stake when you need quick cash. Welcome to traditional asset ownership where your most valuable possessions are locked in legal paperwork that moves at medieval speeds. RWA tokenization is shattering these barriers, converting physical assets into digital tokens that trade 24/7 on global markets.

While DeFi protocols manage over $78 billion in total value locked, traditional assets worth trillions remain siloed in paper-based systems. This disconnect isn’t just inefficient—it’s economically devastating. Property owners wait months for transactions that blockchain could complete in minutes. Investment opportunities remain exclusive to wealthy elites when blockchain could democratize access to any asset class.

The revolution isn’t coming—it’s here. Major protocols are already tokenizing everything from Manhattan office buildings to agricultural land in Brazil. But understanding how property deeds become smart contracts isn’t just technical curiosity—it’s the key to unlocking liquidity from humanity’s largest asset classes.

What Makes Real-World Asset Tokenization Different from Regular Crypto?

RWA tokenization bridges physical and digital worlds by creating blockchain representations of tangible assets like real estate, commodities, or art. Unlike pure cryptocurrencies, these tokens derive value from underlying physical assets and require complex legal frameworks to ensure token holders have enforceable rights to the underlying property.

The Fundamental Challenge

Traditional assets exist in legal systems built for physical ownership. When you own property, your rights come from government-backed legal documents—deeds, titles, and registration systems that took centuries to develop. Real world asset tokenization must somehow transfer these rights onto blockchain while preserving legal validity.

This creates unique challenges that don’t exist in pure crypto:

Legal Recognition: Tokens must represent enforceable ownership rights in courts worldwide. A Bitcoin doesn’t need legal backing—an RWA token representing a warehouse in Texas absolutely does.

Regulatory Compliance: Unlike permissionless DeFi tokens, RWA tokens often fall under securities regulations. They must comply with KYC/AML requirements, accredited investor rules, and jurisdiction-specific asset laws.

Physical World Integration: Smart contracts must interface with physical reality through oracles, legal entities, and custodial arrangements that don’t exist in pure digital assets.

Fractional Complexity: While you can split Bitcoin infinitely, splitting ownership of a building requires navigating property laws, tenant rights, zoning regulations, and tax implications that vary by location.

Why Traditional Methods Fail

Current asset ownership systems create massive inefficiencies. Property transactions require intermediaries—brokers, lawyers, title companies—each adding weeks of delays and thousands in fees. International asset investment becomes nearly impossible for smaller investors due to regulatory complexity and minimum investment thresholds.

Asset tokenization eliminates many intermediaries while creating programmable ownership that can integrate with DeFi protocols for lending, trading, and yield generation.

Essential Components for Successful RWA Tokenization

Successful RWA tokenization requires four critical components: legal framework establishing token-to-asset rights, technical infrastructure for blockchain integration, regulatory compliance systems, and reliable oracles connecting physical assets to smart contracts. Missing any component typically results in failed implementations or regulatory violations.

Legal Framework Architecture

The foundation of any RWA tokenization project is establishing legally enforceable connections between tokens and assets. This typically involves:

Special Purpose Vehicles (SPVs): Legal entities that hold actual asset ownership while issuing tokens representing beneficial interests. The SPV owns the property; token holders own shares in the SPV.

Trust Structures: Alternative legal mechanisms where assets are held in trust, with tokens representing beneficiary interests. This approach often provides clearer legal rights but requires experienced trust administration.

Direct Ownership Models: Emerging frameworks where tokens directly represent fractional ownership rights, though these face significant regulatory hurdles in most jurisdictions.

Technical Infrastructure Requirements

Smart Contract Architecture: Must handle complex ownership scenarios including voting rights, dividend distributions, and transfer restrictions. Unlike simple ERC-20 tokens, RWA tokens need sophisticated logic handling real-world contingencies.

Oracle Integration: Physical assets need reliable data feeds for valuation, condition monitoring, and compliance verification. Chainlink and other oracle providers specialize in feeding real-world data to smart contracts.

Custody Solutions: Physical assets require secure storage and management. This might mean professional property management for real estate or secure warehousing for commodities.

Regulatory Compliance Systems

KYC/AML Integration: Token transfers must comply with anti-money laundering regulations. Many RWA tokens implement transfer restrictions ensuring only verified addresses can hold tokens.

Securities Compliance: Most RWA tokens qualify as securities, requiring registration or exemptions. This affects everything from marketing to secondary trading permissions.

Tax Reporting: Automated systems must track ownership changes for tax reporting across multiple jurisdictions, as token holders may be located globally.

How Physical Assets Actually Become Smart Contract Tokens?

Asset tokenization follows a standardized six-step process: legal structuring, asset valuation and documentation, smart contract development with compliance features, regulatory approval and registration, token minting and distribution, and ongoing asset management through automated protocols. Each step requires specialized expertise and typically takes 3-6 months for real estate projects.

Step 1: Legal Structure Creation (4-8 weeks)

The process begins with establishing legal ownership structures. For a $2 million office building, this typically involves:

Asset Transfer: The property owner transfers the building to a newly created LLC or trust structure. This entity becomes the legal owner while preparing to issue tokens.

Token Rights Definition: Legal documents specify exactly what token ownership means—voting rights, profit sharing, liquidation preferences, and transfer restrictions. These terms get encoded into smart contract logic.

Regulatory Analysis: Legal teams determine which securities regulations apply, what exemptions might be available, and which investors can legally purchase tokens.

Step 2: Asset Documentation & Valuation (2-4 weeks)

Professional Appraisal: Independent valuators assess current market value and establish baseline pricing for token valuation.

Due Diligence Documentation: Complete property history, title verification, environmental assessments, and financial performance records get compiled and verified.

Digital Documentation: All legal documents, appraisals, and due diligence materials are digitized and often stored on distributed systems like IPFS for permanent access.

Step 3: Smart Contract Development (3-6 weeks)

Token Standard Selection: Most RWA projects use modified ERC-20 tokens with additional compliance features. Some use ERC-1400 (security token standard) for more sophisticated regulatory compliance.

Compliance Logic Programming: Smart contracts include automated KYC verification, transfer restrictions, and accredited investor requirements.

Governance Integration: Voting mechanisms for major property decisions, distribution protocols for rental income, and procedures for asset liquidation.

Step 4: Regulatory Approval Process (6-12 weeks)

Securities Filing: If required, filing with relevant securities authorities (SEC in US, FCA in UK, etc.).

Legal Opinion Letters: Law firms provide opinions on regulatory compliance and token holder rights enforceability.

Investor Verification Systems: Implementing systems to verify investor accreditation and maintain compliance records.

Step 5: Token Minting & Distribution (1-2 weeks)

Initial Token Creation: Smart contracts mint total token supply representing 100% asset ownership.

Private Placement: Initial distribution to founding investors, often through tokenization platforms like Republic or StartEngine.

Secondary Market Setup: Establishing trading venues—either through regulated exchanges or compliant DeFi protocols.

Step 6: Ongoing Asset Management (Continuous)

Automated Distributions: Smart contracts automatically distribute rental income or profits to token holders proportionally.

Oracle Integration: Regular asset valuation updates through trusted data providers ensure accurate token pricing.

Governance Execution: Token holder votes automatically execute through smart contracts for qualifying decisions.

Top RWA Tokenization Platforms Compared: Which Solution Fits Your Assets?

Leading RWA tokenization platforms include MakerDAO for established assets, Centrifuge for invoice and trade finance, RealT for retail real estate investment, and Polymath for enterprise securities tokenization. Platform choice depends on asset type, target investors, and regulatory requirements, with costs ranging from $50K to $500K+ for full implementation.

Enterprise-Grade Solutions

Polymath (ST-20 Standard)

- Best For: Large-scale asset tokenization with institutional investors

- Pros: Comprehensive compliance automation, regulatory pre-approval in multiple jurisdictions

- Cons: High implementation costs ($200K+), complex setup process

- Use Case: $50M+ asset tokenization projects with sophisticated compliance needs

Harbor Platform

- Best For: Real estate and investment funds

- Pros: End-to-end legal and technical services, proven track record

- Cons: Limited to specific asset classes, high minimum project sizes

- Use Case: Commercial real estate developments, private equity fund tokenization

Mid-Market Solutions

Centrifuge Protocol

- Best For: Invoice financing, trade finance, and cash-flow generating assets

- Pros: Deep DeFi integration, proven $2B+ in tokenized assets

- Cons: Technical complexity, limited to specific asset types

- Use Case: Supply chain financing, invoice factoring, asset-backed lending

RealT Platform

- Best For: Residential real estate fractional ownership

- Pros: Low minimum investments ($50+), simple investor experience

- Cons: Limited geographic coverage, mostly smaller properties

- Use Case: Rental property investment for retail investors

Emerging Platforms

Ondo Finance

- Best For: Traditional financial products (bonds, treasuries)

- Pros: Institutional backing, regulatory-first approach

- Cons: Limited asset types, newer platform with less track record

- Use Case: Bringing traditional fixed-income products to DeFi

Tangible DAO

- Best For: Physical collectibles and alternative assets

- Pros: Unique asset classes, innovative governance models

- Cons: Highly experimental, liquidity challenges

- Use Case: Art, wine, luxury goods tokenization

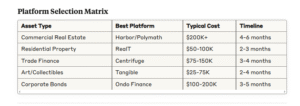

Platform Selection Matrix

Implementation Roadmap: From Concept to Live RWA Tokens

Successful RWA tokenization implementation follows a phased approach: preparation and planning (months 1-2), legal structure and compliance setup (months 2-4), technical development and testing (months 3-5), regulatory approval and launch (months 5-6), and ongoing operations management. Rushing any phase typically results in costly delays or compliance failures.

Phase 1: Foundation Planning (Months 1-2)

Asset Assessment: Determine if your asset is suitable for tokenization. Ideal candidates generate regular cash flows, have clear ownership chains, and face minimal regulatory restrictions. Real estate, equipment leasing, and intellectual property often work well.

Market Research: Analyze similar tokenization projects, investor demand, and competitive positioning. Understanding why previous projects succeeded or failed prevents costly mistakes.

Team Assembly: Engage specialized legal counsel familiar with securities law and blockchain technology. Include financial advisors experienced with alternative investments and technical teams understanding smart contract development.

Preliminary Economics: Model tokenization costs against potential benefits. Include legal fees ($50-200K), technical development ($30-100K), and ongoing compliance costs (5-15% of asset value annually).

Phase 2: Legal Architecture (Months 2-4)

Structure Selection: Choose between direct tokenization (higher regulatory burden, clearer rights) or indirect through SPVs (easier compliance, slightly diluted ownership).

Securities Analysis: Determine if tokens qualify as securities in target jurisdictions. This affects everything from investor marketing to secondary trading permissions.

Documentation Creation: Draft offering memorandums, subscription agreements, and token holder rights documents. These must align with smart contract functionality and regulatory requirements.

Regulatory Strategy: File necessary registrations or claim applicable exemptions. In the US, this might mean Regulation D for accredited investors or Regulation CF for public crowdfunding.

Phase 3: Technical Development (Months 3-5)

Smart Contract Architecture: Develop contracts handling token minting, transfer restrictions, dividend distributions, and governance voting. Include emergency pause mechanisms and upgrade paths for regulatory changes.

Compliance Integration: Build KYC/AML verification systems, investor accreditation checks, and automated regulatory reporting. Many projects integrate with services like Jumio or Thomson Reuters for identity verification.

Testing & Auditing: Deploy contracts on testnets for extensive testing. Professional security audits from firms like ConsenSys Diligence or Trail of Bits cost $20-50K but prevent costly exploits.

Oracle Integration: Establish data feeds for asset valuation and performance metrics. This might include property appraisal services, rental income verification, or commodity price feeds.

Phase 4: Launch & Distribution (Months 5-6)

Private Placement: Initial token distribution to founding investors, often through tokenization platforms or direct relationships.

Secondary Market Access: Enable trading through compliant venues. This might mean centralized exchanges for security tokens or specialized DeFi protocols with compliance layers.

Investor Onboarding: Streamlined processes for new token holders including wallet setup, compliance verification, and educational resources about their rights and responsibilities.

Phase 5: Ongoing Operations

Asset Management: Continuous property management, financial reporting, and stakeholder communication. Token holders expect regular updates on asset performance and strategic decisions.

Compliance Monitoring: Ongoing regulatory compliance including investor updates, financial reporting, and regulatory filing requirements.

Technology Maintenance: Smart contract monitoring, security updates, and feature enhancements based on user feedback and regulatory changes.

Critical Mistakes That Destroy RWA Projects (And How to Avoid Them)

The most common RWA tokenization failures stem from inadequate legal structuring (40% of failures), insufficient regulatory compliance (30%), poor technical implementation (20%), and unrealistic economic models (10%). These mistakes often cost projects $100K+ and months of delays, but are completely preventable with proper planning and expert guidance.

Mistake #1: Legal Rights Confusion

The Problem: Many projects create tokens without clearly establishing what legal rights token holders actually possess. Investors buy tokens thinking they own fractional property, but legally they only own shares in a company that owns property.

Real Example: A 2024 real estate tokenization project raised $2M selling tokens representing “fractional ownership” of luxury properties. When the company went bankrupt, token holders discovered they had no direct claim on the properties—only on worthless company shares.

The Solution: Clearly document and communicate the exact legal relationship between tokens and assets. If tokens represent company shares, state that explicitly. If they represent direct asset ownership, ensure legal structures actually support that claim.

Mistake #2: Regulatory Blind Spots

The Problem: Assuming blockchain technology exempts projects from securities regulations. Most RWA tokens qualify as securities and must comply with relevant laws regardless of their technical implementation.

The Fix: Engage securities lawyers before writing any code. Determine regulatory status early and build compliance into the technical architecture from day one. Retrofitting compliance is exponentially more expensive than building it correctly initially.

Mistake #3: Oracle Dependency Failures

The Problem: RWA tokens need reliable real-world data for valuation and management decisions. Projects often underestimate oracle complexity and costs, leading to stale pricing or manipulation vulnerabilities.

Prevention Strategy: Design oracle systems with multiple data sources and fallback mechanisms. Budget 10-15% of development costs for robust oracle integration and ongoing data feed expenses.

Mistake #4: Liquidity Assumptions

The Problem: Believing tokenization automatically creates liquid markets. Many RWA tokens launch with minimal trading volume and wide bid-ask spreads, disappointing investors expecting crypto-like liquidity.

Realistic Approach: Build liquidity gradually through market makers, strategic partnerships, and integration with established DeFi protocols. Plan for 6-12 months of limited liquidity while markets develop.

The Technical Deep-Dive: Smart Contract Architecture for RWA Tokens

RWA smart contracts extend standard ERC-20 functionality with compliance features, governance mechanisms, and real-world integration capabilities. Key components include transfer restrictions for regulatory compliance, automated distribution systems for asset income, voting mechanisms for major decisions, and oracle integration for asset valuation and management data.

Core Smart Contract Components

Compliance Layer: This ensures only compliant investors can hold tokens and prevents violation of investment limits that might trigger additional regulatory requirements.

Income Distribution System: Automatically calculates and distributes rental income or asset profits proportionally to token holders.

Oracle Integration Patterns

Property Valuation Oracles: Connect to professional appraisal services for regular asset valuation updates. These feeds update token pricing on secondary markets and support lending protocols using RWA tokens as collateral.

Performance Monitoring: For income-generating assets, oracles provide rental payment confirmations, occupancy rates, and maintenance expenditures to ensure transparent asset management.

Compliance Verification: Oracles can verify regulatory compliance, property tax payments, and insurance coverage to automatically trigger alerts when issues arise.

Security Considerations

Multi-Signature Asset Management: Critical functions like asset sales or major expenditures require multiple signatures from designated asset managers and token holder representatives.

Emergency Mechanisms: Pause functions for regulatory compliance issues or asset emergencies, with time-locks preventing abuse.

Upgrade Mechanisms: Planned upgrade paths for regulatory changes or feature improvements, typically requiring token holder approval for major changes.

Real-World Success Stories: RWA Tokenization in Action

Successful RWA tokenization projects include MakerDAO’s $1.2B in real-world collateral integration, Centrifuge’s $2B+ in tokenized invoice financing, and RealT’s $50M+ in fractional real estate ownership. These projects demonstrate proven models for legal compliance, technical implementation, and sustainable token economics across different asset classes.

MakerDAO: The Enterprise Pioneer

MakerDAO revolutionized RWA integration by accepting tokenized real-world assets as collateral for DAI minting. Their approach includes:

Asset Selection: Focus on stable, income-generating assets like corporate bonds and trade finance. This reduces volatility compared to crypto collateral while providing steady yields.

Legal Innovation: Partnership with traditional financial institutions to create compliant asset tokenization pipelines. This bridges DeFi protocols with regulated financial markets.

Risk Management: Sophisticated risk assessment combining traditional credit analysis with on-chain behavior monitoring.

Results: Over $1.2 billion in real-world assets now back DAI generation, proving institutional-scale RWA integration is both possible and profitable.

Centrifuge: Supply Chain Finance Revolution

Centrifuge focuses on business-to-business asset tokenization, particularly invoice and trade finance:

Business Model: Companies tokenize their invoices or purchase orders, creating tradeable assets backed by corporate payment obligations.

DeFi Integration: These asset-backed tokens serve as collateral in lending protocols, creating yield opportunities for DeFi users while providing working capital for businesses.

Scale Achievement: Processing over $2 billion in tokenized business assets demonstrates real-world utility beyond speculative investments.

RealT: Retail Real Estate Access

RealT democratizes real estate investment through fractional property tokenization:

Accessibility: Minimum investments starting at $50 make property investment accessible to retail investors globally.

Geographic Expansion: Properties across multiple US cities provide diversification previously impossible for small investors.

Yield Generation: Regular rental income distribution through smart contracts provides passive income streams.

Transparency: Full property financials, management reports, and performance metrics available to all token holders.

The Economics of RWA Tokenization: Costs, Benefits, and ROI Analysis

RWA tokenization costs typically range from $75K-$500K depending on asset complexity and regulatory requirements, but can unlock 10-50% higher asset utilization through improved liquidity, global investor access, and DeFi integration. Break-even usually occurs within 18-24 months for assets over $1M value, primarily through reduced transaction costs and expanded investor base.

Cost Breakdown Analysis

Legal & Regulatory (40-50% of total costs):

- Securities attorney fees: $50-150K

- Regulatory filing costs: $10-50K

- Ongoing compliance: $25-75K annually

- Jurisdictional expansion: $15-35K per country

Technical Development (25-35% of total costs):

- Smart contract development: $30-80K

- Security audits: $15-40K

- Platform integration: $10-25K

- Ongoing maintenance: $15-30K annually

Asset Management (15-25% of total costs):

- Professional valuation: $5-15K initially, $3-8K annually

- Custody and management: 1-3% of asset value annually

- Oracle services: $2-10K annually

- Insurance coverage: 0.5-2% of asset value annually

Revenue Model Opportunities

Management Fees: Typical 1-2% annual management fees on total asset value provide sustainable revenue streams for tokenization projects.

Transaction Fees: Small fees (0.1-0.5%) on secondary market trades generate revenue while remaining competitive with traditional markets.

DeFi Integration Revenue: Lending protocol integration can generate additional yield through collateral utilization while maintaining asset ownership.

Premium Services: Advanced analytics, institutional reporting, and governance services command premium pricing from sophisticated investors.

ROI Calculation Framework

Traditional Asset Sale: $2M property sale through traditional channels

- Broker fees (6%): $120K

- Legal fees: $15K

- Transaction time: 3-6 months

- Total Cost: $135K, significant time investment

Tokenized Asset Sale: Same property through RWA tokenization

- Platform fees (1-2%): $20-40K

- Transaction time: 24-48 hours

- Global investor access: 10x larger buyer pool

- Total Cost: $20-40K, instant liquidity

Additional Benefits: 24/7 trading availability, fractional sale options, and DeFi protocol integration for yield generation create value impossible in traditional markets.

What is the Future of RWA Tokenization

RWA tokenization is evolving toward institutional-scale adoption with major developments including central bank digital currency integration, automated compliance frameworks, AI-powered asset management, and cross-border regulatory harmonization. These advances will likely unlock $500B+ in additional tokenized assets within two years, fundamentally transforming how global markets operate.

Institutional Infrastructure Development

Central Bank Integration: Multiple central banks are developing frameworks for digital currency interaction with tokenized assets. This would enable instant settlement and reduced counterparty risk for RWA transactions.

Regulatory Sandboxes: Expanding regulatory safe harbors in Singapore, Switzerland, and the UK allow experimentation with novel tokenization structures while maintaining investor protection.

Traditional Finance Partnerships: Major banks and asset managers are building internal tokenization capabilities rather than relying on external platforms, suggesting mainstream adoption is accelerating.

Technical Innovation Pipeline

AI-Powered Asset Management: Machine learning algorithms will optimize property management decisions, predict maintenance needs, and automatically adjust token valuations based on real-time performance data.

Cross-Chain Standardization: Emerging standards will enable RWA tokens to operate seamlessly across different blockchain networks, expanding liquidity and investor access.

Automated Compliance: Smart contracts will automatically adjust to regulatory changes across jurisdictions, reducing ongoing compliance costs and expanding global accessibility.

Market Expansion Predictions

Asset Class Diversification: Beyond real estate and traditional securities, expect tokenization of intellectual property, carbon credits, infrastructure projects, and even human capital investments.

Geographic Expansion: Regulatory clarity in major markets will unlock tokenization of assets in emerging economies, potentially democratizing global investment access.

DeFi Protocol Integration: Native RWA support in major lending protocols will create seamless bridges between traditional asset ownership and DeFi yield opportunities.

Final Thougts: Your RWA Tokenization Action Plan

Immediate Next Steps:

- Assess Your Assets: Determine which assets generate consistent cash flows and have clear ownership structures

- Engage Legal Counsel: Securities attorneys specializing in blockchain prevent costly compliance mistakes

- Choose Your Platform: Match asset type and investor target with appropriate tokenization platform capabilities

- Plan Your Economics: Model costs, timeline, and potential ROI before committing significant resources

Strategic Considerations:

- Start Small: Pilot with single assets before scaling to portfolio tokenization

- Plan for Compliance: Regulatory requirements dominate project timelines and costs

- Build for Liquidity: Token value depends heavily on secondary market development

- Integrate with DeFi: Maximum value comes from enabling tokenized assets to participate in broader DeFi ecosystem

Timeline Expectations:

- Simple residential property: 2-4 months, $75-150K total cost

- Commercial real estate: 4-6 months, $200-400K total cost

- Complex assets (businesses, IP): 6-12 months, $300-750K total cost

The RWA tokenization space is rapidly maturing from experimental projects to institutional-grade infrastructure. Success requires careful planning, adequate budgets, and realistic timelines—but the potential to unlock trillions in previously illiquid assets makes it one of the most significant opportunities in modern finance.