Table of Contents

Cryptocurrency exchanges are the backbone of the digital asset ecosystem. Whether you’re an entrepreneur, a fintech innovator, or a blockchain enthusiast, the decision to build a Centralized Exchange (CEX) or a Decentralized Exchange (DEX) is pivotal. This in-depth article aligns the operational, technical, and cost perspectives, blending user-focused storytelling with real-world data and development insights for 2025. If you’re weighing CEX vs DEX Development, this guide is tailored for you.

What Are CEX and DEX?

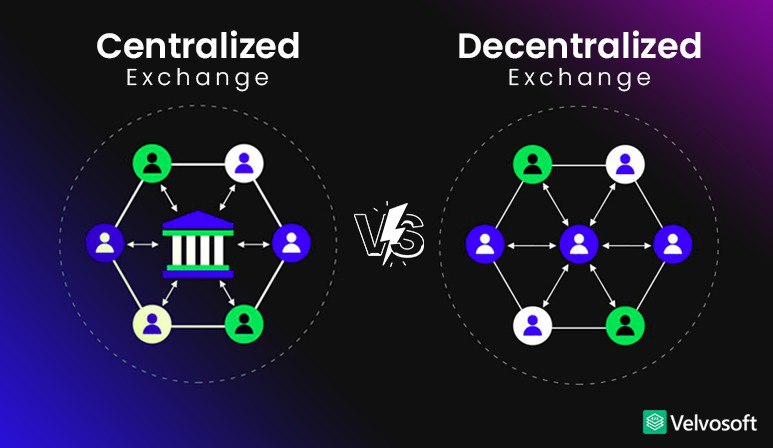

f I tell you to picture a marketplace where an authority regulates the system like a bank regulates its account holders, that’s a CEX run by a company, offering smooth user experiences, fiat on-ramps, and customer support. On the other hand, imagine a marketplace where the authority is missing and everyone controls the system and regulates themselves. That’s a DEX a open-air digital bazaars run by code, letting users trade directly from their wallets, prioritizing privacy and decentralization. Understanding these differences is crucial for anyone considering CEX vs DEX Development.

The Origins: How Did We Get Here?

Centralized Exchanges (CEXs): CEXs like Coinbase (2012) and Binance (2017) made crypto accessible to the masses. Their user-friendly interfaces, deep liquidity, and fiat support fueled mainstream adoption. By first quarter (Q1) of 2025, the top 10 CEXs processed $5.4 trillion in spot trading volume, with Binance alone holding a 40.7% market share.

Decentralized Exchanges (DEXs): DEXs emerged from the DeFi movement, aiming for trustless, censorship-resistant trading. Uniswap (2018) revolutionized the space with automated market makers (AMMs) and liquidity pools. By 2025, DEXs like Uniswap and PancakeSwap handle hundreds of billions in quarterly volume, with Solana-based DEXs accounting for 39.6% of all DEX trades in first quarter of 2025. The rapid evolution of both models has made CEX vs DEX Development a hot topic among blockchain startups and established fintechs alike.

How do They Work?

CEXs or Centralized Exchange:

- Users deposit funds and trade via centralized order books.

- Require KYC/AML for compliance.

- Offer advanced trading tools and customer support.

DEXs or Decentralized Exchange:

- Users connect wallets and trade via smart contracts.

- Use AMMs and liquidity pools for pricing and execution.

- No central authority or KYC for most platforms.

For anyone considering CEX vs DEX Development, understanding these operational differences is essential.

Advantages: Why Choose One Over the Other?

Choosing Exchange system is vital decision for you cause it’s decide your whole system and fluency of the work.

CEX Advantages

Speed & Liquidity: High trading volumes mean fast execution and minimal slippage.

Fiat On-Ramps: Buy/sell crypto directly with fiat currencies.

Customer Support: Dedicated teams for account issues.

Advanced Features: Margin, derivatives, and more.

Security Measures: Insurance funds, cold storage, and compliance programs.

DEX Advantages

Privacy: No KYC, trade without revealing your identity.

Decentralization: No single point of failure, users control their funds.

Open Access: Anyone with a wallet can trade.

Token Variety: Many new tokens debut on DEXs.

When it comes to CEX vs DEX Development, your priorities like speed, privacy, control, or regulatory compliance will guide your choice.

Disadvantages: What Are the Trade-offs?

This system has some types of the disadvantage for the work system and you need to understand it comprehensively.

CEX Disadvantages

Custodial Risk: Funds are at risk if the exchange is hacked.

Regulatory Pressure: Accounts can be frozen or blocked.

Privacy Concerns: KYC/AML stores user data.

DEX Disadvantages

Slippage & Liquidity: Lower liquidity can mean higher slippage for large trades.

Gas Fees: On-chain transactions can be expensive.

Usability: Interfaces can be complex; no customer support.

Limited Features: Most DEXs only support basic swaps.

CEX vs DEX Development is not just about features; it’s about understanding the risks and limitations unique to each model.

Real-World Use Cases

Use a CEX when:

- You need fiat on-ramps/off-ramps.

- You want high liquidity and advanced trading features.

- You value customer support.

Use a DEX when:

- You prioritize privacy and self-custody.

- You want access to new or experimental tokens.

- You’re comfortable managing your own wallet.

What is the Development Costs: CEX vs DEX Development in 2025

Development costs are a major factor in your decision. Here’s a side-by-side comparison, based on the latest industry data:

White-label solutions can reduce costs and time to market for both models, with CEX white-labels starting around $20,000–$100,000.

Development Process: What’s Involved?

CEX Development Steps:

- Market research and compliance planning

- UI/UX design and prototyping

- Back-end and trading engine development

- Security implementation (encryption, 2FA, cold storage)

- KYC/AML integration

- Liquidity provider integration

- Testing, deployment, and ongoing support

DEX Development Steps:

- Smart contract and blockchain development

- UI/UX for wallet-based trading

- Liquidity pool and AMM implementation

- Security audits (smart contracts)

- Testing, deployment, and community building

A successful CEX vs DEX Development project depends on following the right process for your chosen model.

Which Is Right for You: CEX vs DEX Development?

Choose a CEX if:

- You’re targeting mainstream users and want fiat support.

- You have the resources for regulatory compliance.

- You need advanced features and high liquidity.

- You can invest in robust security and ongoing maintenance.

Choose a DEX if:

- You serve privacy-focused, DeFi-native, or global users.

- You want to minimize custodial risk and empower users.

- You’re ready for technical challenges in smart contract and liquidity management.

- You want to innovate in DeFi or experiment with new token models.

FAQ: Your Top Questions Answered

Q1: Which is more expensive to develop, a CEX or a DEX?

A CEX is typically more expensive due to regulatory, security, and infrastructure requirements. DEXs can be less expensive but need specialized blockchain developers and ongoing audits.

Q2: Which is easier to launch quickly?

White-label CEXs can launch in weeks; custom CEX or DEX development takes months. DEXs may launch faster if built on existing protocols, but liquidity and security setup are critical.

Q3: What are the biggest security risks?

CEXs face hacking and phishing risks due to centralized custody. DEXs are vulnerable to smart contract bugs and exploits. Both require strong security and regular audits.

Q4: How do I attract users and liquidity to my exchange?

CEXs rely on marketing, fiat support, and customer service. DEXs use liquidity mining, token incentives, and aggregator integrations.

Q5: What about compliance and regulation?

CEXs must comply with KYC/AML and licensing. DEXs often operate permissionlessly but face increasing regulatory scrutiny. Modular compliance frameworks are emerging for DEXs.

Q6: Can I combine both models?

Yes. Hybrid exchanges are emerging, blending centralized liquidity and support with non-custodial wallets and decentralized order matching.

Ultimately, the CEX vs DEX Development debate is about aligning your business goals, technical expertise, and user needs.

Future Outlook: Hybrid Models and Industry Evolution

The distinction between CEX and DEX is fading as hybrid models gain traction. These platforms offer the liquidity and support of CEXs with the privacy and control of DEXs. In 2025, expect further innovation in cross-chain trading, Layer 3 scaling, and privacy tech, making exchanges faster, cheaper, and more user-centric.

In summary:

Your choice between CEX and DEX development should align with your business goals, technical expertise, regulatory appetite, and user base. CEXs offer scalability and mainstream appeal but at higher cost and compliance burden. DEXs provide innovation, privacy, and user empowerment but require technical excellence and creative growth strategies. The future likely belongs to platforms that blend the best of both worlds, adapting as user needs and regulations evolve.